Bullets:

China’s central bank has currency swap agreements with dozens of countries, and trillions of dollars in goods trade are now settled in Chinese renminbi.

The US Dollar remains the dominant reserve currency globally. But a severe shortage of dollars in many systems opens the door to Chinese companies, who can transact business outside the USD.

BRICS expansion is another driver of the internationalization of the RMB, along with the urge of many countries to de-risk from Western banking systems.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

Last month, we visited an elevator manufacturing company in Foshan. Hassan Ablajan is Global Sales Director for Siglen Elevator, and he told us that 30% of his company’s sales outside China are settled in renminbi, the Chinese currency.

That is far more significant that it sounds, because it means that this company can operate in markets, and compete against American and European and Japanese elevator companies for customers who otherwise would need to have a lot of dollars or euro or yen, to buy their models.

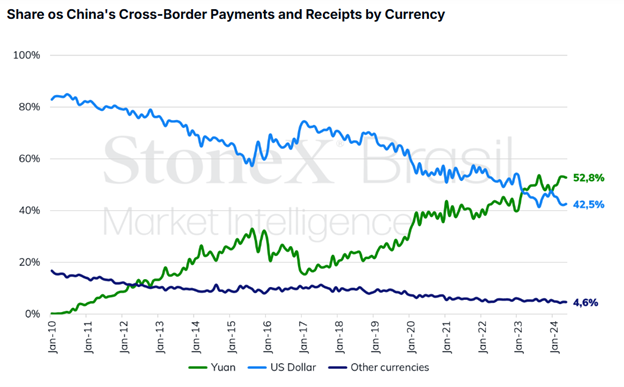

As an international payment and settlement currency, the Chinese yuan is growing very fast. These data are for China’s trade with its partners, and settlements in renminbi went from zero fifteen years ago, to over half by 2024. In 2025, the trend continued: nearly $2 trillion US dollars’ worth of trade were settled in RMB, up 11% over 2024. Renminbi are used for 39% of China’s goods trade, a quadrupling in eight years.

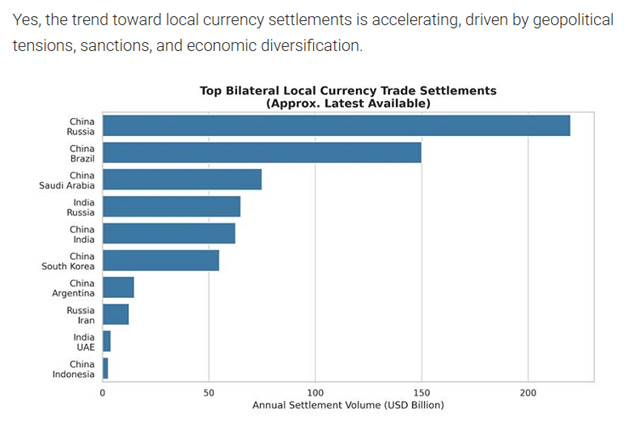

These data are annual settlement volumes using renminbi, measured in dollars: with Russia, over $225 billion US. Brazil, at $150 billion per year. Saudi Arabia, $70 billion.

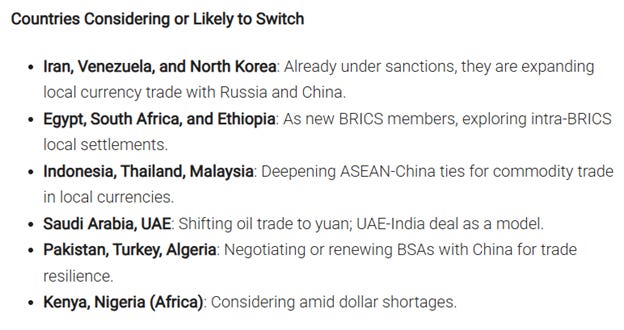

A score of countries here on this table that are considering switching, and those are some of the reasons why. Countries under sanction by Western governments, obviously, who cannot access US dollar markets or go through SWIFT banks are top of the list. BRICS expansion is another driver, as Global Majority countries are building a new financial system, outside the dollar.

Countries in Africa are looking to move, because of dollar shortages in their systems. The United States runs massive fiscal deficits, which need to be financed, and that is draining dollars from banking systems across the world. The US government offers far higher borrowing rates than other developed countries, especially compared to China, to attract those dollars back to Washington, to be spent there.

This is the definition of “reserve currency”. It’s a foreign currency held by central banks, and used primarily to settle global trade, stabilize the currency at home, and pay for imports. They are considered “safe havens, highly liquid and stable. Used to buy and sell, and pay debts. Central banks use them to reduce exchange rate risk. The dollar has been the world’s dominant reserve currency since 1945.

With that definition there in mind, consider news features like these. Zambia: China operates mines in Zambia, who has agreed to collect taxes and royalty payments in renminbi—not dollars—and will then use the renminbi to buy products and pay loans from China. The country has a shortage of US dollars, so the question begs itself: why doesn’t Zambia insist on payment in USD? China’s got a lot of dollars too, and Zambia doesn’t have enough. So why use Chinese yuan? What’s more, analysts realize that what just happened in Zambia is a template for other African countries who do a lot of trade with China, who also can’t get dollars.

It’s “a practical solution”, to them, to replace US dollars–the world’s dominant reserve currency–with Chinese renminbi. By doing so, African governments – or for that matter, any of the other governments on that table – can cut transaction costs, more easily service debt, and do so without the risk of having sovereign assets seized by Western regulators. Saying that in a different way: Zambia is short of dollars, and China is a buyer of what comes out of Zambian mines. It’s easier for all involved just to use RMB instead of dollars.

Given the definition of “reserve currency” our question becomes, is the Chinese renminbi not already functioning as a reserve currency? The very first condition is that a reserve currency is held by central banks, in large volumes. They do not do so as a store of value, but primarily for trade settlement.

As of two years ago, the People’s Bank of China had signed 40 currency swap agreements with foreign central banks. These allow for central banks, on either side, to immediately convert domestic currency to foreign. Over half a trillion dollars were in force at that time. Saying that differently, over $500 billion in renminbi FX reserves can be created, on demand, by 40 central banks using these currency swap windows.

Back to Siglen Elevator, then. Accepting payment in Renminbi is a powerful driver of sales at Siglen elevator, today, and for thousands of other Chinese companies doing business across the world. Dozens of countries in Africa, like Zambia, and here in Asia, and in South America, are developing fast. They’ve got the same problems the Zambians have—US dollars are hard to get, so it’s difficult for their local companies to buy products denominated in USD. But if their country does a lot of trade with China, they can use RMB instead, to buy elevators—and cars and tractors and power stations and 5G equipment—from China.

These countries are not merely replacing dollars with RMB for international trade and settlement finance. They’re replacing western vendors with Chinese ones.

Be good.

Resources and links:

Bilateral Currency Swap Agreements and Local Currency Trade Settlements

https://www.newscentralasia.net/2026/01/26/bilateral-currency-swap-agreements-and-local-currency-trade-settlements/

Comments on the use of the Chinese yuan as an international payment currency

https://www.stonex.com/en/market-intelligence/use-of-the-chinese-yuan-as-an-international-payment-currency-1508767/

China’s plan to internationalise yuan quietly takes a step forward as Zambia gets on board

https://www.scmp.com/news/china/diplomacy/article/3341799/chinas-plan-internationalise-yuan-quietly-takes-step-forward-zambia-gets-board

What China’s yuan internationalisation push looks like – and what may hold it back

https://www.scmp.com/economy/china-economy/article/3337438/what-chinas-yuan-internationalisation-push-looks-and-what-may-hold-it-back

China’s central bank signs 40 currency swap agreements with foreign counterparts

https://english.www.gov.cn/news/202402/16/content/_WS65cef3efc6d0868f4e8e40d3.html

WATCH HOW: China has taken over the elevator manufacturing industry

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.