Bullets:

The “Trump Trade” is driving Wall Street brokers to drain copper from exchanges across the world, to earn high premiums in the United States.

Fifty percent US tariffs on refined copper products, but not on the raw, have created a boom in speculation in the metals markets in New York, while drawing down inventories available for manufacturers, construction, and infrastructure.

Even higher tariffs are likely later in the year, and investment banks are advising their HNW clients and positioning portfolios accordingly.

China enjoys strong relationships with the world’s top copper producers, but their manufacturers are being squeezed. In response, China is building a “copper empire” in Shandong, which will serve as the country’s primary smelting and supply chain hub.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

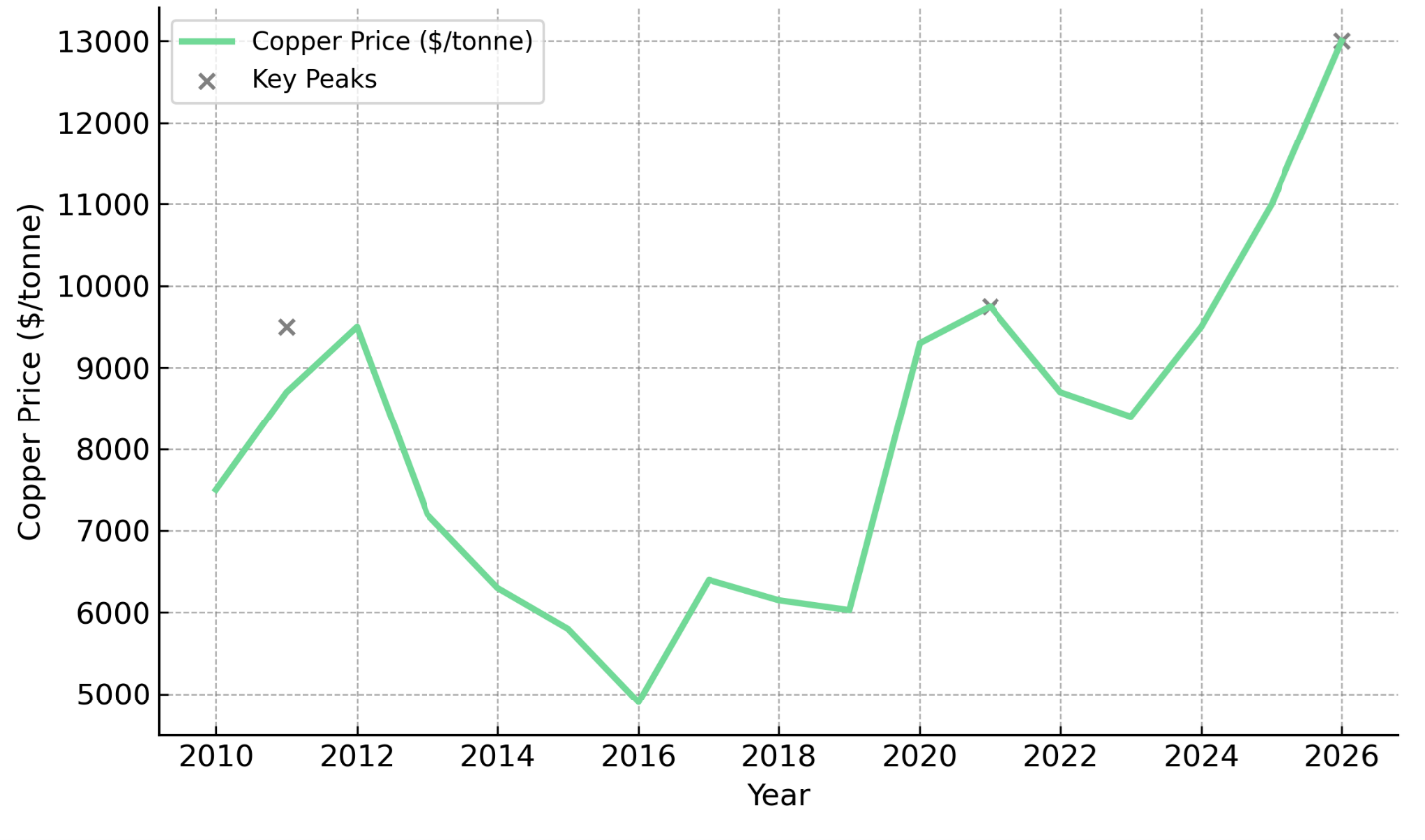

Copper prices are hitting all-time highs, and US tariffs on copper are driving speculators to this market, and redirecting copper trade flows from industrial and factory sectors that use copper to build things. Metals exchanges are stockpiling copper to meet demands from Wall Street traders, while product manufacturers and infrastructure engineers are seeing shortages.

The objectives of the tariffs may have been to kickstart new copper mines in the United States, but it takes so long to get mining permits approved, and costs so much to get them started, that the only mines anyone wants are those with fixed assets invested at lower cost, from years ago, and which come with the regulators’ approvals, also from years ago.

In the past, price jumps in copper came from China, or from large infrastructure projects. Now it’s a different world. Copper is a strategic material, and there are severe constraints on the new supply side.

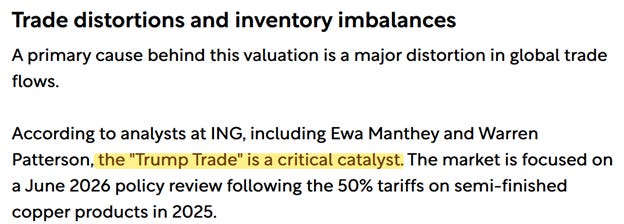

That would be true anyway, but the new tariffs from the Trump Administration brought in waves of speculators. A 50 percent tariff on semi-finished copper product imports to the US, but a tariff exemption for raw copper, led immediately to shortages on the metals exchanges, and huge premiums between the US price, and the prices on the LME, in London.

Traders make more money shipping raw copper to the United States and collecting that premium, than manufacturers make building things. So that is what is driving the market, for now, and it might get worse later in the year if the Commerce Department puts on another 15% tariff for next year, and 30% in 2028.

Nobody has any idea what the rules are, even now, let alone later, and that makes it difficult for investors and project developers who make long-term capital budget decisions.

The “Trump Trade” is what the brokers are calling it, and traders are shipping copper to the United States, where it gets stashed into warehouses, where a record 450,000 tons is sitting at the COMEX in New York. This is just to settle trades. The rest of the world doesn’t have enough. In China, copper inventories at the Shanghai exchange is down over half since last August, and the whole world outside Lower Manhattan is running out.

Industry analysts warned about this very thing just before the 50% tariffs on copper went on, and that it would damage the American construction sector. Copper mining takes forever in North America, and cannot meet current global demand, so the tariffs will only cause a spike in prices, supply chain problems, and higher costs for construction and energy.

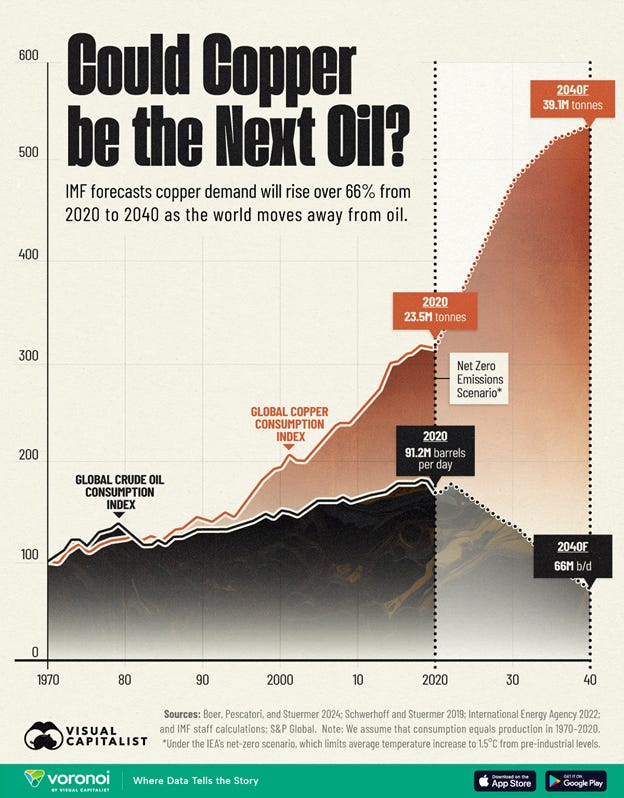

These are two strong data points that illustrate the problem: 42% of copper consumption in the United States is by the construction industry. Outside the US, 70% is used for electronics, renewable energy, and electric vehicles. Green energy projects use 12 times more copper than fossil fuel systems, and electric cars demand more than twice as much. And the entire world is building data centers and AI, which is another huge driver of copper demand.

Economists at the IMF forecast another two-thirds rise in copper demand in the next 15 years, while demand for oil drops by more than one third.

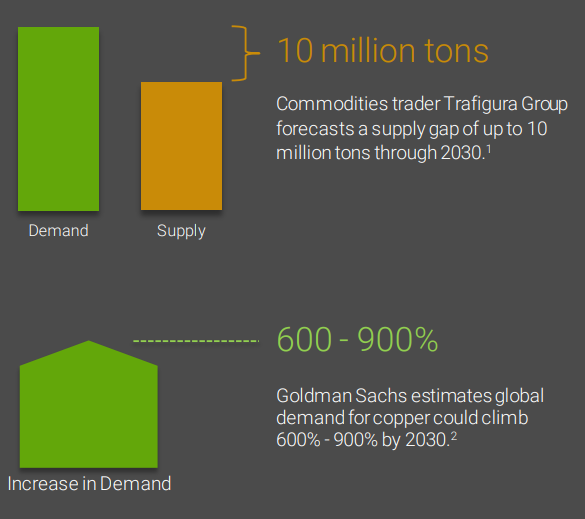

This is an investment circular that predated the Trump tariffs, and points out that copper demand is only going a lot higher, while supply is not:

Goldman Sachs thinks the people at the IMF are way too low on their demand forecasts, and if Trafigura and Goldman agree there that copper demand is going to be screaming much higher and much faster, that explains why Wall Street traders are stockpiling the copper instead of letting construction companies have it.

So the question begs itself: where will all this demand from industry be met, given that nobody believes that the US or Europe will be opening up hundreds of new copper smelters this month? And we should assume too that China doesn’t want to be reliant on Goldman Sachs, or Trafigura – for anything.

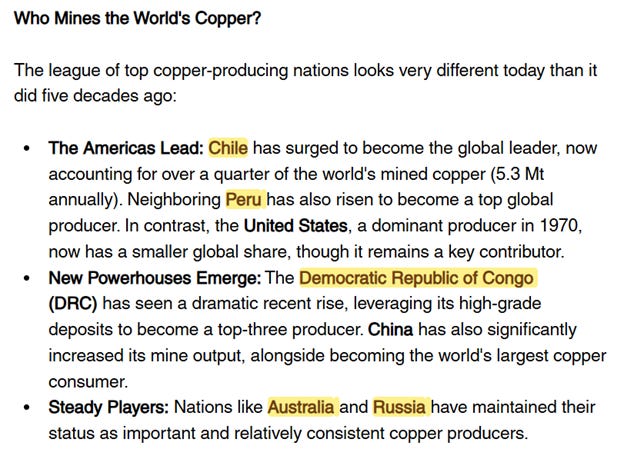

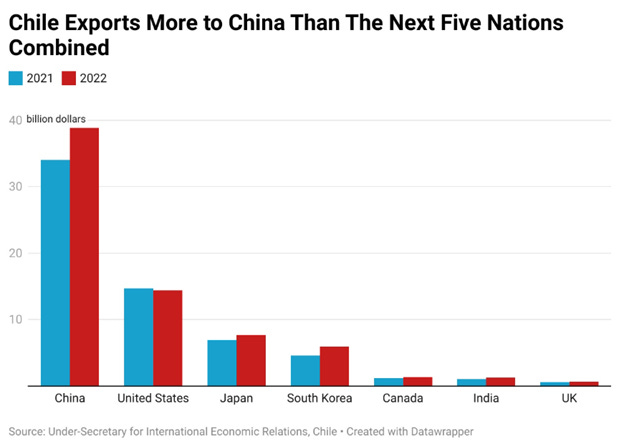

This is where copper comes from. Chile and Peru are the top global producers today. The DRC is number three, and Australia and Russia are also key copper producers. China has deep diplomatic and trade relationships with all those countries, and just completed a huge deep-water port in Peru. And Chile’s trade agreements with China are the longest-running in South America. Chile is China’s largest and most important supplier of copper, and exports more to China than to the next five countries combined:

So China is in a strange spot. They have tight relationships with the world’s top producers, but their problem is that their manufacturers buy copper only when they need it, not before, and that just-in-time model is in trouble when Goldman Sachs and their clients want all the copper in New York to speculate with.

The plan here is to build a new “copper empire” in Shandong province, to be a key hub for smelting and supply chain managers who need copper to build actual products. China is the world’s biggest importer and consumer of copper, and after satisfying copper demand in the domestic market, Shandong hopes to export to countries involved in the Belt and Road Initiative projects.

Goldman Sachs is even quoted in this piece from the South China Morning Post, in Hong Kong. They say tariffs are going higher, no doubt getting inside information from the White House and advising their clients accordingly, and that means even tighter copper supplies for people who use it to make real things.

Be Good.

Resources and links:

China’s relations with Chile, it’s oldest friend in South America

https://thechinaproject.com/2023/07/18/chinas-relations-with-chile-its-oldest-friend-in-south-america/

Could copper be the new oil?

https://res.americancentury.com/docs/market-minute-could-copper-be-new-oil.pdf

Charted: Copper vs. Oil Demand (1970-2040)

https://www.visualcapitalist.com/charted-copper-vs-oil-demand-1970-2040/

China’s copper heartland vows to build US$28 billion empire, dominate in global market

https://www.scmp.com/economy/china-economy/article/3336261/chinas-copper-heartland-vows-build-us28-billion-empire-dominate-global-market

Copper’s Break Above $13,000: Structural Context for the Price Move

https://www.cruxinvestor.com/posts/us-trade-policy-uncertainty-supply-disruptions-push-copper-beyond-13-000

Supply Chain, Why Trade Shocks are Pushing Copper Prices to Record Highs

https://supplychaindigital.com/news/trade-shocks-copper-prices-record-highs

Trump’s Proposed 50% Copper Tariff: What It Means for the U.S. Construction Industry

https://news.constructconnect.com/trumps-proposed-50-copper-tariff-what-it-means-for-the-u.s.-construction-in

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.