Bullets:

China is again buying US soybeans, in accordance with the framework agreed to in November. Cargoes on order thus far total 10 million tons, providing American farmers some relief.

But soybean prices are drifting lower, while soybean farm expenses are up over 12% since 2024.

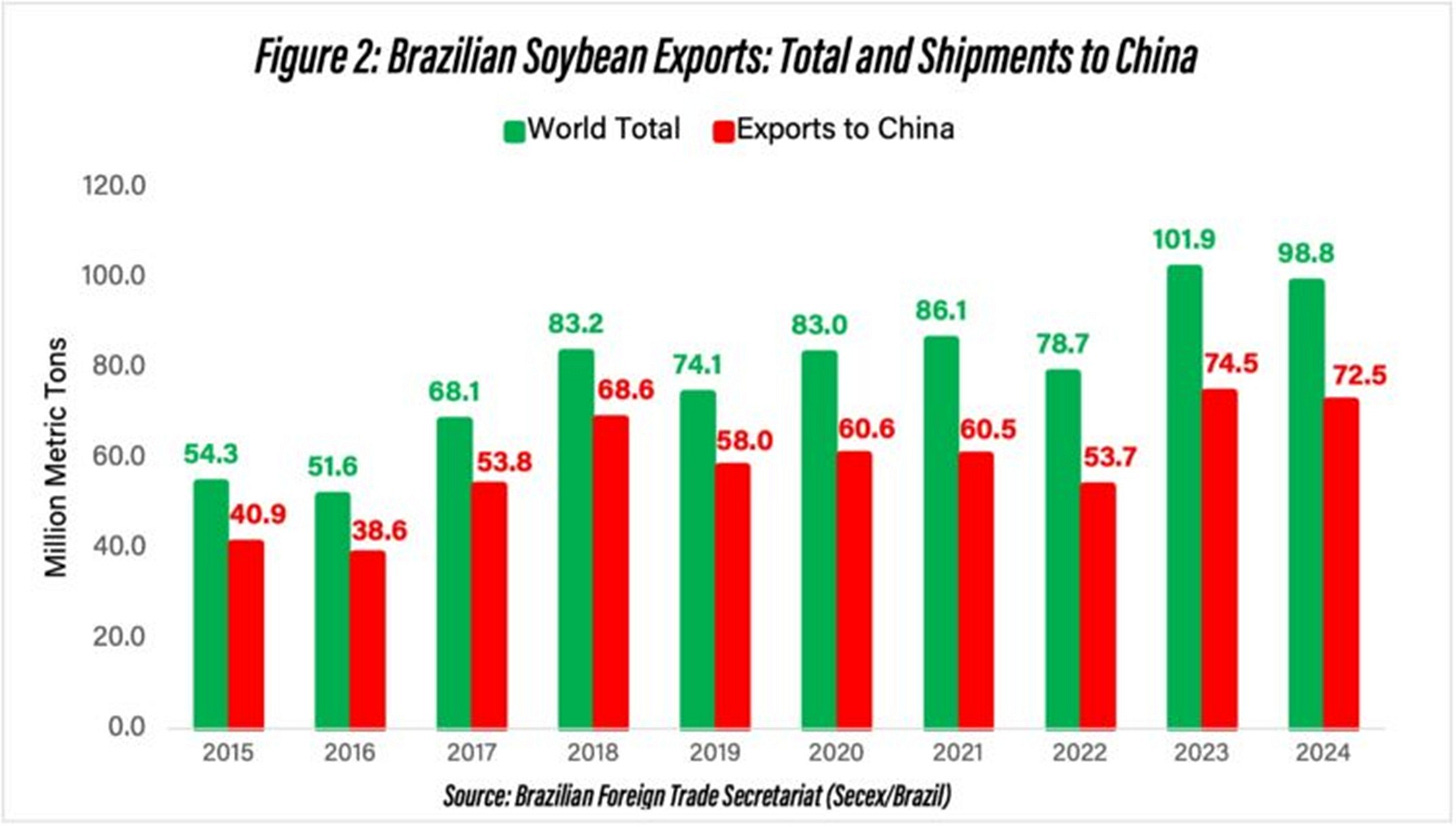

Brazil has recently announced a record crop, and insiders there and in China forecast soybean shipments to China will reach 100 million tons in 2026.

The trade deal from November locks in China to 25 million tons of soybean buys, per year, for the next three years. Those volumes are 14% lower than the average from previous years, and are likely to command even lower prices, given massive soybean harvests in South America.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

This was a major news story here in China, and a serious unforced error by a handful of companies in Brazil. Five soybean exporters there have been banned by China’s authorities, after a shipment containing about 70,000 tons of soybeans was found to contain ten tons of wheat, which was treated with a pesticide that is toxic if consumed by humans, or by animals, and Brazilian wheat is not allowed to be exported to China anyway.

Brazil has over 2,000 facilities with export clearance for soybeans to China, and over 100 million tons will come over this year. So those 10 bad tons in a shipment of 69,000 tons, in a market of a hundred million tons, is statistically zero. But we mention it, to demonstrate how tightly regulated this system is, how closely the cargoes are inspected and tested before anything gets unloaded to supermarkets or feed lots here.

Please, keep this in mind before you send my group an email, asking how to get your food products approved to sell in the Chinese market. I probably cannot help you, and I don’t need my name in the papers here if someone on your side does anything wrong. This is a “serious violation”, the embassy is involved, and it matters not whether this was a really dumb one-time mistake, or something deliberate and worse—this is already an expensive problem for those five companies here, for just ten tons.

This episode coincides with a ramp-up of Chinese imports of US soybeans, with a total thus far of 10 million tons since the tentative trade deal back in November. Sinograin ordered 10 shipments of soybeans, totaling 600,000 tons, for delivery later in the spring. Add up those cargoes with the previous ones, China has bought 80% of what they pledged to buy by the end of February.

So that’s the good news, that China is back, again buying soybeans from American farms. The first bad news is that the prices just keep going lower. Soybean futures spiked on news of the trade deal, which the White House called a “blockbuster deal” for soybean farmers. For each of the next three years, China pledged to buy 25 million tons of American soybeans. But since that announcement and jump in price, soybean markets have been selling off.

Recall that even after the scandal with the Brazilian shipment, Brazil will ship at least a hundred million tons to China this year, and Brazil soybeans are less expensive, AND – this is the second round of bad news for US farmers–Brazil projects a record soybean crop. For 2025-26, Brazil will see a record harvest of 177 million tons.

That’s a 3.6% increase in volume, and that same increase in acreage. And there is the money line: Brazil’s soybean farmers are making more money, so they’re planting more acres. Even given the falling prices for soybeans, Brazil’s farmers are earning higher profits anyway, and opening new fields.

The American soybean supplier market is heading the other direction. Farmers there are reducing acreage, and their costs are rising as crop prices are falling.

There is more bad news, when we dig in to what the trade deal really did, which was to codify China’s commitment to replace the United States as a primary supplier for its soybeans. This analysis is from November, three months ago. The trade deal is a “relief”, but the “volume is limited.”

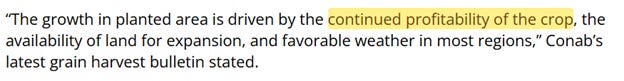

If everything goes off as promised—if China’s buys do hit the 12 million tons for 2025, that would be a total of 18 million tons, which is a third lower than in 2024. The red bars on this chart represent US soybean exports to China, so 18 million tons for 2025—and as of today we are still two million short—would make it the lowest since 2018:

Then we have the 25-million-ton commitment, the blockbuster great deal. That comes in 14% lower than the recent five-year average of 29 million tons a year. The agreement to lock in 25 million tons of soybean exports to China, in other words, just formalizes what we already know—China’s imports of US soybeans are ratcheting lower, while China’s imports from Brazil are rocketing higher.

In 2024, Brazil’s exports of soybeans to China were 72 million tons. For 2026 Brazil’s shipments will be over 100 million tons. Just that difference, the increase in buying from Brazil from a 2024 to this year, is 28 million tons, far more than all the imports from US farms.

Be Good.

Resources and links:

Farmland Shock: Georgia Grower Drops 3,000 Acres, Warns of Unplanted Ground in 2026

https://www.agweb.com/news/business/farmland/farmland-shock-georgia-grower-drops-3-000-acres-warns-unplanted-ground-2026

Brazil projects record soybean crop and growing exports, citing demand from China

https://www.michiganfarmnews.com/brazil-projects-record-soybean-crop-and-growing-exports-citing-demand-from-china

Agreement pauses rare earth restrictions and lowers some levies, but analysts warn key disputes remain unresolved

https://www.scmp.com/news/china/article/3331140/trump-hails-lasting-deal-xi-dangles-more-possible-tariff-cuts

Soybean futures, trailing 3 months

https://finviz.com/futures/_charts.ashx?p=d&t=ZS&r=m3

China halts soy imports from Brazil plants, pivots to US amid food safety probe

https://www.scmp.com/news/china/diplomacy/article/3334588/china-halts-soy-imports-brazil-plants-pivots-us-amid-food-safety-probe

Brazil Agriculture Ministry Says China Banned Five Soy Exporters

https://www.agriculture.com/partners-brazil-agriculture-ministry-says-china-banned-five-soy-exporters-11859231

China buys more US soybeans, total purchases approach 10 million tons

https://www.reuters.com/world/china/china-buys-more-us-soybeans-total-purchases-near-10-million-tons-2026-01-06/

U.S.–China Soybean Deal: Comparing Past Export Levels and Global Market Impacts

https://ag.purdue.edu/commercialag/home/resource/2025/11/u-s-china-soybean-deal-comparing-past-export-levels-and-global-market-impacts/

Bloomberg, China buys two thirds of pledged US soybeans

https://www.bloomberg.com/news/articles/2025-12-31/china-buys-two-thirds-of-pledged-us-soybeans-as-2025-closes

The Rising Cost Squeeze: Soybean Farmers Face a Third Year of Losses

https://soygrowers.com/news-releases/the-rising-cost-squeeze-soybean-farmers-face-a-third-year-of-losses/

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.

There has to be a way to turn soy into a sugary syrup.