Bullets:

Gold prices are soaring to record highs as investors, central banks, and BRICS nations are dumping dollars in a race to build gold reserves.

De-dollarization is a stated policy objective for governments in BRICS countries. Dollars and Euro are swept out of Western banking systems as earned in trade surplus, and much of it is used to buy gold to haul back to domestic vaults.

But today almost all the world’s central banks are aggressively building out their own gold reserves. Gold is a “safe haven” asset, and cannot be inflated away, but more importantly cannot be frozen or seized if held on deposit outside SWIFT systems.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

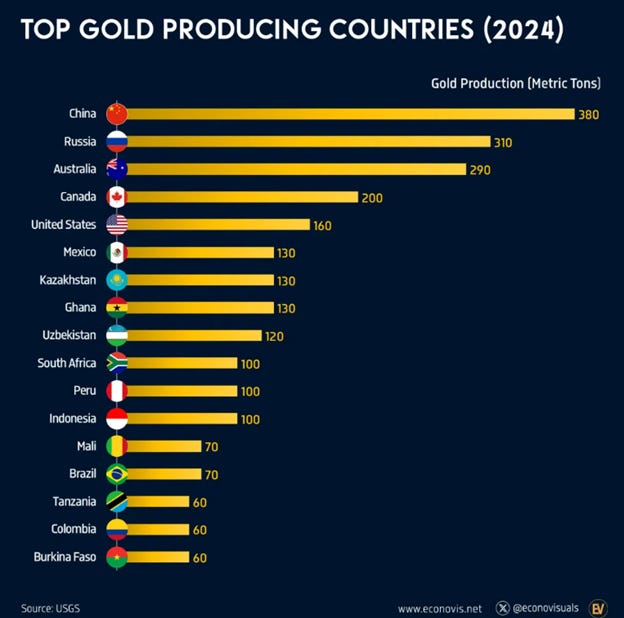

The BRICS bloc of countries mine half of the gold in the world. That’s what they pull out of the ground. China is the world’s largest gold producer, Russia is second. South Africa, Indonesia, and Brazil are also BRICS countries, and Kazakhstan and Uzbekistan are partner countries, so that makes seven out of the top fourteen gold producing countries:

What’s curious is that the central banks of these countries are also buying gold, on world markets. The objective of that strategy is to reduce their reliance on the US dollar, and on Western banking systems to trade with each other. It was probably inevitable eventually, but the effort got turbo-charged when Western banks froze, then seized, Russian FX reserves in European banks. That caused governments everywhere else to ask some tough questions about where reserves should be, and how they should be denominated.

What is the risk to assets held in banks in the US or in Europe? And, could regulators in Washington or Brussels nullify or freeze USD or Euro in banks in other countries?

Nobody knows what the rules are anymore, and nobody can afford to find out the hard way.

So even though BRICS countries mine a lot of gold, they are aggressively buying more on global markets, while moderating their exposure to dollars. Gold prices are soaring: investors in the US are buying gold to protect against the US dollar losing value because of high inflation, and central banks are buying gold to protect against their dollar reserves being inflated away or seized outright.

Within this bloc, about a third of trade is settled in local currencies. It’s obviously faster and less expensive to use local currencies, instead of routing everything through New York or London, but there is also no risk of sanctions or having the funds frozen by Western regulators or politicians.

China is the world’s biggest consumer of gold bullion, and it typically trades at a discount to spot gold in the world markets, because of how much gold is coming out of Chinese mines. But that discount is narrowing again, because of the surge in the gold price coming from higher inflation expectations, geopolitical risk, central bank buying, and de-dollarization. China’s central bank has bought gold for 14 months in a row, and officially holds about $320 billion in gold reserves.

But it’s not just the BRICS countries, with central banks who are cashing in their dollars for gold. The US dollar and Western banking systems – recently – were considered the ultimate safe havens. Now they’re not:

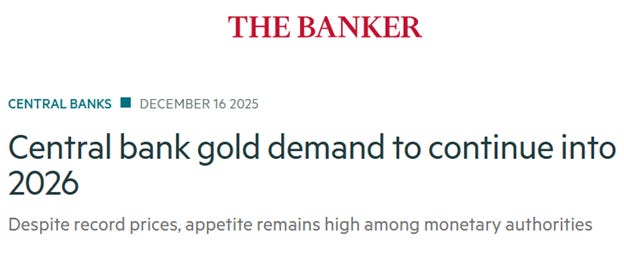

Central banks are selling dollars – trading them for gold – and hauling the gold back to vaults at home. Central banks are indifferent to the gold price—they don’t care what this chart does. Price goes up, they are still buyers, because diversification away from the US dollar is their long-term strategy.

95% of central banks say gold reserves will increase over the next year. Central banks are usually run by professional economists, and good luck getting them to agree on anything. But 19 out of 20 say they need more gold reserves.

Central banks outside North America and Europe have the capacity to add even more gold holdings. That’s because they often run high trade surpluses. Bank of Brazil – again, Brazil already mines a lot of gold – announced they would be adding to its reserves for the first time in five years. The Bank of Korea is getting back in after 12 years. Brazil and Korea, both, have high trade surpluses—billions of dollars a month coming in from trade.

In the past they would reinvest those surplus dollars into US Treasury bonds, or hold them on deposit in banks in New York or Europe. Instead they’re buying gold. China’s trade surplus hit $1 trillion last year, hitting all-time highs in November of last year, despite the high tariffs. China is a net seller of Treasuries, and its holdings of US government bonds just hit their lowest level in decades.

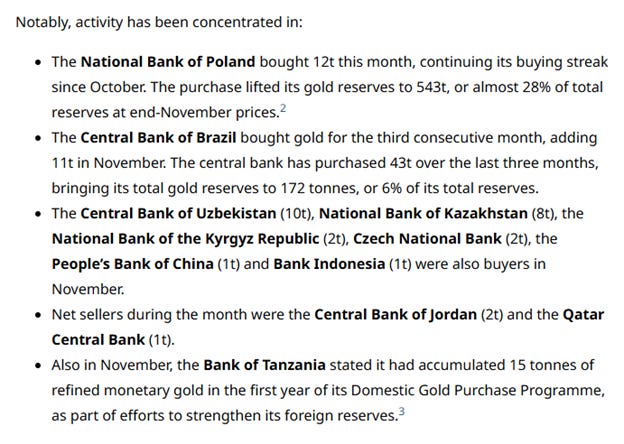

Across all central banks, buying is steady, even with rocketing gold prices. This is a gold market snapshot, from the month of November. Net sellers were Central Bank of Jordan, and Qatar. Poland, Brazil, Czech National Bank, Indonesia, Tanzania—all were accumulating gold, replacing fiat currencies issued by governments elsewhere.

Be good.

Resources and links:

China’s November net gold imports via Hong Kong more than doubled from October

https://www.reuters.com/world/asia-pacific/chinas-november-net-gold-imports-via-hong-kong-more-than-doubled-october-2025-12-29/

China’s central bank buys gold for 14th consecutive month

https://www.mining.com/web/chinas-central-bank-buys-gold-for-14th-consecutive-month/

Central bank gold demand to continue into 2026

https://www.thebanker.com/content/09369b02-a590-44d9-b572-ffc4afae72e0

Central bank gold statistics: Buying momentum continues into November

https://www.gold.org/goldhub/gold-focus/2026/01/central-bank-gold-statistics-buying-momentum-continues-november

Top Gold Producing Countries (2024)

https://www.voronoiapp.com/wealth/-Top-Gold-Producing-Countries-2024-4501

BRICS nations control 50% of global gold output in shift away from US dollar

https://www.intellinews.com/brics-nations-control-50-of-global-gold-output-in-shift-away-from-us-dollar-417952

BRICS nations ditch dollar for gold in global finance power grab

https://www.intellinews.com/brics-nations-ditch-dollar-for-gold-in-global-finance-power-grab-416694

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.