Student loan debt is rising so fast that most graduates are functionally in a debt prison they will never escape from. Things have gotten so out of hand that lawyer and activist Peter Stefanovic described the situation as follows:

Jeez. This is completely insane. How has this been allowed to happen? pic.twitter.com/5UF7lK9cxE

— Peter Stefanovic (@PeterStefanovi2) January 13, 2026

Student loan debt bad and getting worse

Tony Blair introduced fees in 1998, with the amount increasing to £3,000 a year in 2004. In 2012, the Tory-Lib Dem coalition tripled this to £9,000, with more increases following since then.

While any debt is bad enough, it’s even worse when interest rates are high. Sky News reported on the worsening situation in the below clip:

A report on the interest paid on student loans. As Sophy Ridge says, its staggering.

To people who say we can’t afford to scrap student loans or write off the debt (we can), why can’t the loans be made interest free? pic.twitter.com/EzZGHPpksX

— Saul Staniforth (@SaulStaniforth) January 13, 2026

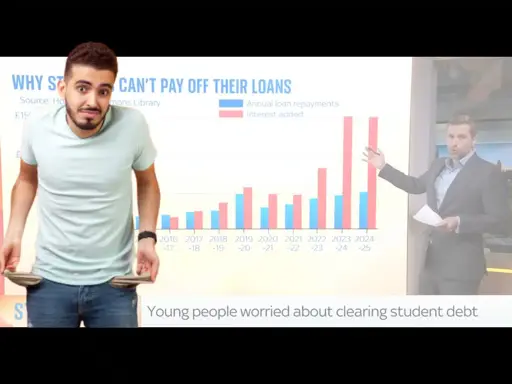

In the clip, the host shows the following graph, explaining that the blue bars are debt while the red ones are added interest:

As you can see, interest was originally way below overall debt. Now, it’s so much higher that it’s hard to wrap your head around.

As Skyexplained:

in 2012, there was a new repayment plan called Plan 2 that was brought in. This was brought in to coincide with tuition fees going up to £9,000. And Plan 2 said that students had to repay their loan at an interest rate of inflation plus 3%.

This plan came into effect in 2016-17, with debt skyrocketing ever since.

Sky added:

inflation jumped… around the Ukraine war, massively increasing the amount of interest these people had to pay, with no cap on it… many people might argue [that having a cap] would be a fairer fair way of doing it.

And I think just adding to the problem of this is these are people who started university 2012, 2013, 2014, when interest rates were incredibly low.

In other words, most students had no idea that they’d signed up to take on debt that they’d never be able to pay back.

People have spoken about their own problems with student debt:

Student loans should be 0% interest.

I’ve been working at between a minimum of £45k per annum since graduating 9 years ago, with my more recent salary being 6 figures.

I barely make a dent on the loan and most years it didn’t cover the interest. I owe more than I borrowed by… https://t.co/Km56vijgrz

— Matt Lismore (@MattLismore) January 11, 2026

People also explained the numbers:

The student loan scandal – interest on loans is more than the repayments for many on Plan 2 so debt grows trapping them with extra 9% income tax for up to 30 years https://t.co/1kw8ZC6Efi £15.2 billion interest added to student loans last year, only £5 billion repaid. pic.twitter.com/k9dllnouQy

— Paul Lewis (@paullewismoney) January 11, 2026

Interest being charged to student loans is criminal. Plan 2 people will never pay it off even if it’s written off it erodes people’s incomes. So regressive https://t.co/d6cgIdiS3j

—

(@MrLewisVuitton) January 13, 2026

People are also arguing that the problems aren’t a bug; they’re a feature:

This is entirely the point of student loans – to ensure if you don’t have wealthy parents you earn 9% less than someone who had wealthy parents. For your whole life. For doing the same job.

Education and work were never meant to allow you to escape the class system. https://t.co/eupvr8y0gh

— Jonathan (@jabberwock951) January 12, 2026

Who could have seen it coming?

We’ve been reporting on the impossibility of paying off loans for years, with Nathan Griffiths reporting in 2019:

The debt figures also include student loans. with tuition fees rising to £9,250 per year in 2017. The extortionate rise, coupled with rising student loan interest rates, means many students will never pay off this debt. Research from the Institute for Fiscal Studies (IFS) showed that around 83% of graduates will have part of their debt written off and only 17% will pay it off fully.

Yet again, it’s an entirely predictable problem that the establishment failed to anticipate (or ‘didn’t care to think about’, anyway, because the politicians who implemented these fees knew they wouldn’t have to deal with the fallout).

While Tony Blair, David Cameron, and Nick Clegg are gone, Keir Starmer is not.

Whether he likes it or not, Starmer – or his inevitable replacement – need to tackle this problem ASAP, because this problem is only worsening the cost of living crisis.

Featured image via Sky News

By Willem Moore

From Canary via This RSS Feed.