Bullets:

The Pentagon has been cut off from China’s rare earth metals that are crucial in advanced weapons manufacturing.

A bigger issue is that researchers are finding new applications for rare earths, and those are in high demand by engineers building railroads, pipelines, and hydropower and renewables projects.

NATO and Washington are desperate to build a domestic industry for rare earth extraction and refining, which will take decades. But eventual suppliers will have a small numbers of buyers, and a handful of engineers from the munitions industry building new technologies and markets.

In contrast, tens of thousands of civilian engineers and a dozen of the top universities in China are designing and patenting advanced applications for rare earth metals for civilian use.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

China has strict export bans on many of the materials and metals that are critical for advanced weapons systems. “Dual-use” means that a technology has both civilian and military applications, and it’s a serious challenge for the Pentagon that so many of their supply chains run through China.

Those are getting cut off, and that problem now drives American foreign policy—the need to source these materials from other countries, or quickly ramp up production in the United States. Major weapons projects, such as the F35 fighter upgrade, are being delayed, because the Pentagon can’t get these four rare earth elements that are on China’s export ban list.

For China, this represents a simple opportunity cost problem. Rare earth metals and magnets that go to Pentagon weapons systems are materials that are not available to modernize their own armed forces.

But an even bigger issue is that these are materials now in high demand in China’s commercial and industrial sectors. China has functional monopolies on the mining and refining of rare earth metals, and those are now desperately needed for their own civilian projects. It’s not, then, merely a question of whether Chinese rare earths should be used to build new fighter jets for the United States, when China also builds fighter jets for its own Army. It’s that China builds everything else, and many of their biggest infrastructure projects also need them. High speed rail and energy projects, for example, need as much as they can get.

The Baotou Steel Union Company is in Inner Mongolia – that is a province of China, not the country. Inner Mongolia is home to over a third of the world’s light rare earth reserves. The company produces 33 varieties of rare earth steel, which dramatically improves the quality of the steel, corrosion resistance, and weldability. Infusing rare earths into steel this way also makes the steel much more valuable.

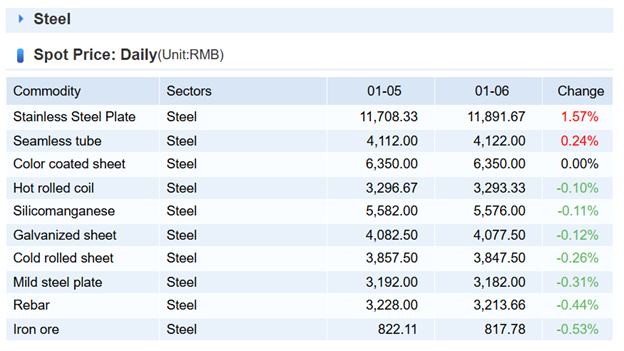

This is the daily spot price of Chinese steel, in renminbi. By adding rare earth elements to the steel, Baotou Steel can get an extra 3,000 RMB per ton, and BSU’s excess profits from rare earth steel were 3.6 billion RMB. So dividing that 3.6 billion by that 3,000 RMB per-ton premium, BSU sells 1.2 million tons of rare earth steel, and their capacity now is 1.5 million tons per year.

Over a million tons a year of rare earth steel is far more than enough to upgrade a bunch of fighter jet engines, or build a new submarine for the Navy. But we can see the problem, if Chinese engineers need it to build thousands of miles of new high-speed rail here in Mainland China, or if other engineers need it to build railroads in Europe, or elsewhere Asia.

Rare Earth Steel is also ideal for use in extreme cold, so it’s in high demand by oil and gas engineers building pipelines across Siberia to hubs in North China. Over 60,000 tons are going to Xizang – Tibet – to build the world’s biggest hydropower project.

This is a serious challenge moving forward, right here. The Pentagon is desperate for rare earth metals, to build weapons systems. But it’s not a priority for other industries, because we don’t have them. We don’t build High Speed Rail, or new hydropower projects. The renewable energy industry is dead and buried, in the United States; President Trump has shut that down.

So all these big plans from Washington and Wall Street–these investments in new mines for rare earth metals—it’s all intended for one buyer. It’s true that the Pentagon will buy all the rare earth steel, in this instance, that they will need to get the F35’s back into the air. But that’s all they will buy.

So there is a hard ceiling on the demand side, for any of these new producers for rare earth applications. In the United States, the Pentagon is the only customer they will ever have. Researchers in China’s top universities, and tens of thousands of engineers across China are at work, right now, developing new applications and markets for their rare earths, so that more companies can do just what Baotou Steel Union did for steel– blend some light rare earth metals in, make it stronger, double the price, and sell it to railroads and pipelines and renewable energy companies – AND to the Chinese military.

Be Good.

Resources and links:

How Will China’s Rare Earth Export Controls Impact Industries and Businesses?

https://www.china-briefing.com/news/chinas-rare-earth-export-controls-impacts-on-businesses/

Why China’s growing demand for rare-earth steel is bad news for US F-35

https://www.scmp.com/news/china/science/article/3336457/why-chinas-growing-demand-rare-earth-steel-bad-news-americas-f-35

China steel, spot price

https://www.sunsirs.com/uk/sectors-13.html

China plans 19% high-speed rail expansion by 2030 amid global dominance in the sector

https://www.scmp.com/economy/china-economy/article/3338778/china-plans-19-high-speed-rail-expansion-2030-amid-global-dominance-sector

China’s Tibet Megadam project: 10 years, $170 billion for another Great Britain

Pentagon to become largest shareholder in rare earth miner MP Materials; shares surge 50%

https://www.cnbc.com/2025/07/10/pentagon-to-become-largest-shareholder-in-rare-earth-magnet-maker-mp-materials.html

Pentagon moves to build $1 billion critical minerals stockpile to counter China — report

https://www.mining.com/pentagon-moves-to-build-1-billion-critical-minerals-stockpile-to-counter-china-report/

Pentagon to keep investing in US critical minerals projects, defense official says

https://www.reuters.com/world/china/pentagon-keep-working-with-us-rare-earths-projects-us-defense-official-says-2025-07-15/

The Pentagon’s Rare Earth Gamble: Smart Strategy or State-Crafted Monopoly?

https://www.rusi.org/explore-our-research/publications/commentary/pentagons-rare-earth-gamble-smart-strategy-or-state-crafted-monopoly

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.