Bullets:

China is a major buyer of Venezuelan crude oil, and will probably look to secure new sources of supply.

But there is little urgency for them to do so. Oil prices are falling, and other suppliers are eager to step up their exports to China, and were doing so before the takeover of Venezuela.

China also is at surplus for crude oil imports, and in November alone was over 1.8 million barrels, per day, that went into storage.

Chinese inventory builds and draws are now the most important driver in crude oil markets.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

Venezuela is front and center in global politics, and in energy markets. Nobody has much of an idea of what’s coming next, but it’s widely assumed that it’s a major negative for China, who is a major buyer of Venezuelan crude oil, and that other oil suppliers will need to be found.

But that is probably the wrong answer, for two big reasons. This is the map of the oil producing countries who are members of OPEC or OPEC+, and Venezuela is a member of OPEC.

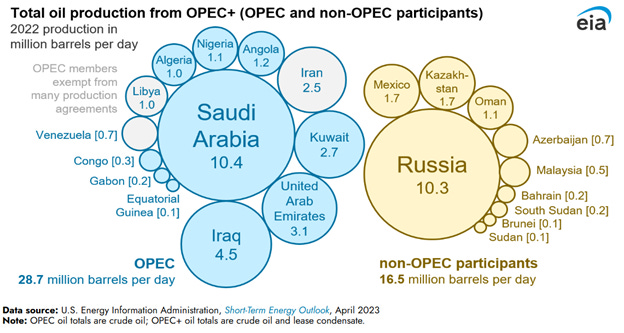

Here, though, are the data for how much crude is produced, by country: OPEC in total is 28.7 million barrels per day. Venezuela is just 700,000 bpd. Saudi is almost 15 times bigger. Russia isn’t a member of OPEC, but Russia also pumps over 14 times more crude than Venezuela does:

So that’s the first problem, for the thesis that Venezuela is going to deeply impact China. Venezuela simply doesn’t produce enough to make much of a difference. But the second issue is that China is very well-insulated from any supply-side shocks for oil, no matter where from.

This is a surprising situation now, for economists and experts in the oil market. China is the world’s biggest importer of crude oil, and the world’s biggest consumer of oil. The traditional thinking – until recently – is that it is the oil suppliers, like OPEC+, who determine the global price for oil, and that big importers, like China, are price takers in the market. Now, if the market faces oversupply, it would be OPEC members who would be price takers, temporarily, until they can push production down to balance supply and demand again.

But a new development has scrambled all that convention wisdom: China’s enormous – and still growing – oil storage industry. That is putting a floor on the global prices—Chinese buy when oil prices fall enough, and stash the surplus into their tanks. But there is also a ceiling on price—if prices rise, China will just reduce imports or draw down inventories until prices fall again.

Here we get again into the Venezuelan question. The global oil market is huge, and crude producers are happy to fill up ships and send them this way. In November, Chinese oil imports from Saudi were 1.59 million barrels per day, an increase of 345,000 bpd. Iran—1.35 million barrels per day, up 233,000 from the previous month. Those INCREASES in oil buys from Saudi and Iran were nearly 600,000 barrels per day, while Venezuela’s entire production is 700,000 bpd. Oil tankers will simply fill up in the Middle East instead of in Venezuela. Or China can just buy more from Russia again. If they want. But they’re already at surplus, so there’s no urgency on their part to do anything.

The Chinese then are buying massive volumes of surplus crude, and the timing couldn’t be better. Oil prices keep grinding lower: China keeps importing record volumes of crude, keeps consuming high volumes, and keeps stuffing hundreds of thousands of barrels a day—every day—into storage tanks. And they are also building a lot more of those, with another 170 million barrels of capacity coming online before the end of this year.

So there is China’s strategy—they are happy to buy up more crude for storage and that puts a floor on prices. And if prices go up again, China will just cut back imports or draw down inventories. Put all this together, and it is China’s inventory flows – oil moving into and out of storage – are the most important drivers of oil prices. Iran and Israel bomb each other for weeks it didn’t matter. Venezuela can go completely offline and it won’t matter, to anyone outside Venezuela.

Be good.

Resources and links:

Reuters, China overtakes OPEC+ as the main oil price maker

https://www.reuters.com/markets/commodities/china-overtakes-opec-main-oil-price-maker-2025-12-22/

China accelerates crude stockpiling amid weaker oil price trend

China’s November crude oil imports reach highest daily level in 27 months

What is OPEC+?

https://www.eia.gov/todayinenergy/detail.php?id=56420

Maduro, Venezuela, The U.S.—And The Oil Shock China Can’t Price In

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.