Bullets:

Foreign buyers are scooping up Chinese used cars, with export volumes more than tripling year over year.

China’s new car prices continue to fall, and households are trading in late-model cars to buy new.

The vehicles preferred by foreign fleet buyers tend to be late-model cars and trucks from globally recognized brands, but built in Chinese factories.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

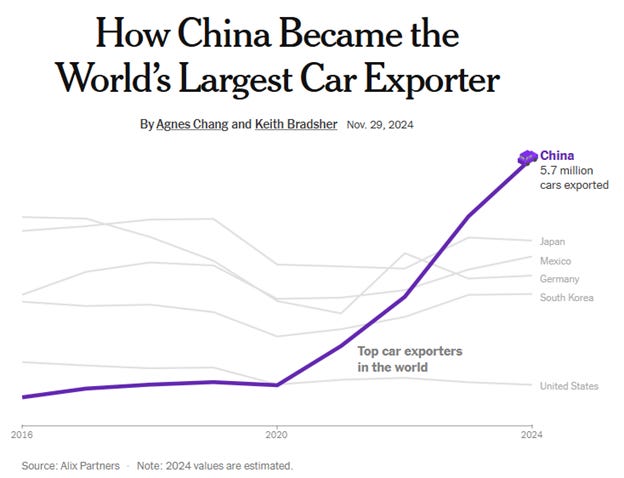

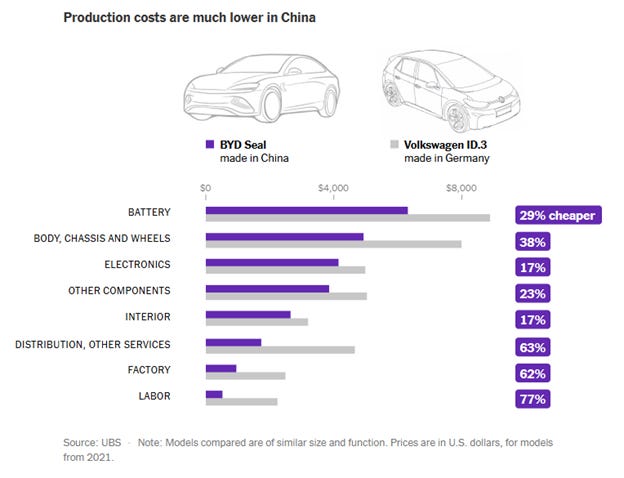

China is the world’s largest car market, about as big as the US and Western European markets combined. China’s is also the world’s largest exporter of vehicles, and the lower manufacturing cost is a primary driver. The Seal from BYD and the VW ID3 are cars with similar specs—they’re both electric, but the manufacturing cost differences jump off the page. The Seal is built in China, and the VW is from Germany. Across the board, everything costs less by double-digit percentages—but the biggest of all are in logistics and distribution, the factory cost, and labor:

What’s more, in China’s domestic market, prices for new cars are falling. Ruthless efficiency in the Chinese factory sector means deflation and lower prices for almost everything. And it’s that particular data point which is driving a new export boom in used cars from China.

In 2023 Chinese firms exported used cars to over 140 countries. The catalyst for this industry is the rapid turnover of cars in China’s domestic market—new car prices are falling, and buyers are trading in even late-model used vehicles to buy new.

This is an updated report, and in 2024, 400,000 used cars were shipped to over 160 countries. There are 195 countries in the world, so over four-fifths of countries are importing used cars from China.

Chinese companies in the market are trying to get away from price, as the differentiator for used cars, and shift instead to perceptions of quality and to ‘brand trust’. My company is familiar with that part. The inquiries we get from fleet dealers in Europe and Africa are specific, they want used cars, fewer than five years old, from Chinese factories that build Western brands. There are dozens of those–Chinese plants that build for Ford and GM, and Volvo and Mercedes. Almost all our requests are for gas-powered cars and trucks, not electric. And they’re also vehicles with strong brand recognition in foreign markets—for the used cars, many buyers prefer Western brands and designs, but the price advantages that come from building them in a Chinese factory. Their mechanics are already familiar with those vehicles, so they’re easier to maintain and repair. And the tariffs are lower too.

There are some big advantages here to fleet buyers—used car dealerships, car rental agencies; the companies that buy ten or more vehicles at a time. New cars are sold through dealership networks, and those dealers have protected sales territories and price guarantees. Pre-owned vehicles don’t move through those sales channels, so buyers are dealing directly with the logistics and inspection companies in China.

Exports of used cars is a new industry in China. The first car export deal was just six years ago, in July 2019. Three hundred cars from Nansha Port, in Guangdong. Nansha is the one of the biggest used car export hubs for China, with over 200 companies there. Exports of pre-owned vehicles outbound Nansha Port in 2024 were over 33,000 – more than three and a half times higher than 2023, and about that again in car export value.

Shanghai Port is heavily investing in the industry also, and are also seeing exponential export growth. In the first 11 months of 2025, Shanghai exported over 20,000 used cars, more than double what Shanghai shipped in 2024.

Looking more closely at the 2024 export value figures, outbound Nansha Port: A total export value of $547 million, for 33,486 used cars. That is over $16,000 per vehicle, on average. So these are high-end cars and trucks, they’re late-model vehicles, high quality, and with strong brand recognition. That’s what foreign buyers are after.

Be good.

Resources and links:

Surging demand driving China’s used-car exports

https://global.chinadaily.com.cn/a/202509/08/WS68be3310a3108622abc9f5d3.html

China’s used vehicle exports rise exponentially

https://www.arabnews.com/node/2470521/business-economy

Platform launched to boost used car exports

https://www.chinadaily.com.cn/a/202512/19/WS6944a533a310d6866eb2f6d9.html

China’s Auto Boom Accelerates on Surge in Gasoline Model Exports

Guangdong accelerates development of pre-owned vehicles export industry

https://en.people.cn/n3/2025/0507/c90000-20311581.html

New York Times, How China Became the World’s Largest Car Exporter

https://www.nytimes.com/interactive/2024/11/29/business/china-cars-sales-exports.html

And the “Factory of the Year” award goes to Daimler’s plant in China

https://mercedesblog.com/factory-year-award-goes-daimlers-plant-china/

Bloomberg, Carmakers Slash Prices Again in China, Defying Regulators

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.