Bullets:

American buyers of aluminum are paying record spreads over global benchmarks, amid Trump’s 50% tariffs and worldwide shortages of industrial metals.

A small handful of US firms are benefitting from the squeeze and are even modestly increasing production. But the shortage of aluminum globally is 2 million tons per year.

Outside China, production of aluminum continues to decline.

Chinese aluminum smelters have the capacity to close the gap and lower prices. But regulators here are prioritizing China’s domestic supply chain for bauxite, and have placed hard ceilings on aluminum production, and reduced exports of finished aluminum products.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

For the YouTube video for this report, please follow this link:

Report:

Good morning.

Markets for industrial metals are going crazy, because of the tariffs and the trade wars and China’s export bans on dual-use applications for anything coming out of their refineries here.

Now it’s aluminum, with prices hitting multi-year highs, because of the new import tariffs and shortages in the spot markets. The Midwest premium for aluminum is at a record high. That is what US buyers pay—prices are quoted on the LME, and the Midwest Premium is added to that benchmark price to cover freight and import taxes to the United States. The exchange price for aluminum is $2,850 a ton, plus freight and tariffs to US markets takes it to $4,792 a ton. The import duties nearly tripled, from $560 per ton to over $1400, since January.

The tariffs are driving that record spike in the Midwest Premium. The market believes now that President Trump’s 50% tariffs on imported aluminum, mostly from Canada, are here to stay. Aluminum consumers in the US are paying much more, but the high tariffs have benefited a small handful of American suppliers.

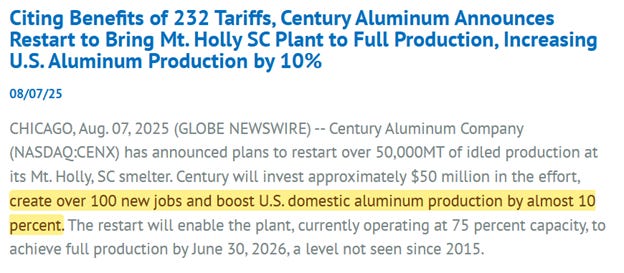

Century Aluminum is a big fan of the high tariffs, and announced plans to restart a smelter in South Carolina, creating over 100 new jobs by next June.

ALCOA is the biggest aluminum producer in the United States, but they source a lot of their supply in Canada. That resulted in the company paying $69 million more in tariffs this quarter compared to last. But they’re booking higher profits anyway, because aluminum prices are so high. “Rising US prices have more than made up” for the unfavorable tariff impact to the company. Alcoa announced they are stepping up their buys of Canadian aluminum to previous levels, paying the 50% tariff and passing along higher prices to US buyers.

US prices for aluminum are rising much faster than in other markets, with the Midwest Premium more than doubling in five months. That’s because of the tariffs. But China is deeply impacting the aluminum markets with their policy changes. Chinese regulators are placing hard ceilings on domestic production of aluminum, which is tightening supplies everywhere else.

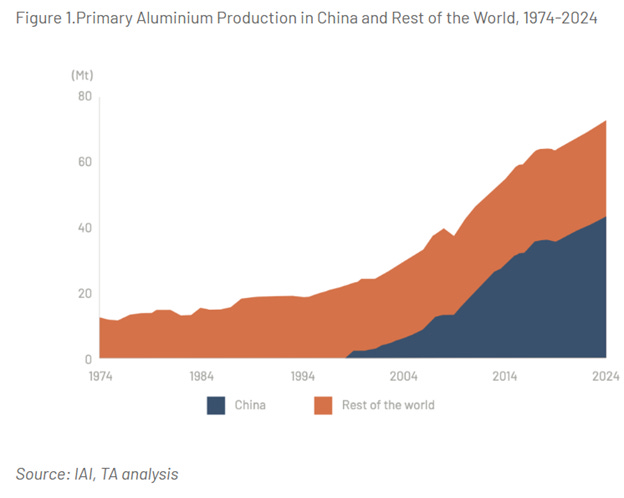

China is the world’s largest producer and consumer of aluminum, with 60% of the global total. In 1949, China produced 10 tons of aluminum. Last year it was 40 million tons.

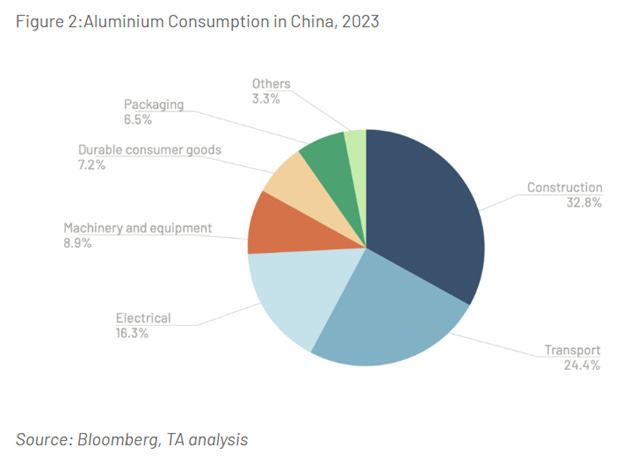

Here is the 50-year chart, and China doesn’t show up at all until 2000 or so, and 25 years on, today produces more aluminum than the rest of the world combined. Here’s where that Chinese aluminum is going. Construction and transportation are more than half. Capital equipment is 8.9%–durable consumer goods, is 7%. So all this aluminum is mostly consumed here, in China, except for the consumer goods and packaging that are headed to export markets:

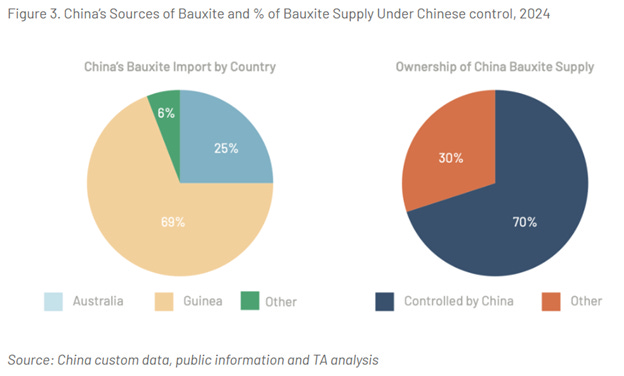

But this is the problem, as far as China is concerned: They have a supply chain dependency on imported bauxite. China’s bauxite reserves only add up to 2% of the global supply. What’s more, only the bauxite in Guangxi province is high-grade. So China needs to import the bauxite ores, for refining here. Guinea and Australia together are over 90% of China’s bauxite imports. 70% of the mines are owned or controlled by Chinese firms, but Chinese policymakers are taking steps to increase domestic supplies, and to reduce that dependency.

It starts with a production limit of 45 million tons, and China’s domestic producers aren’t bumping their heads on that ceiling, yet. They hope that buys them some time to expand domestic reserves to 5% of the world’s total, up from 2%. And there is a new push for recycled aluminum, with a target of 15 million metric tons of recycled by 2027. This strategy, they hope, will make China’s aluminum supply chain more resilient and secure in the next two years.

But here is where that leaves things outside China. US consumers are having more trouble finding aluminum, and the shortage of aluminum in markets outside China will be 1.8 million tons. China’s exports of finished and semi-fab aluminum products have dropped by 900,000 tons per year. That is half of that global shortage, then. And aluminum production outside China is also falling, by 1.1 million tons per year. A two-million-ton decline in overall aluminum availability outside China.

Two million tons, short. Going back to that press release from Century Aluminum. They’re excited to restart 50,000 metric tons of idled production. So, we need 39 more of those. And a lot more bauxite.

Be Good.

Resources and links:

The Chinese Aluminium Sector: Challenges and opportunities for decarbonisation

Aluminium Price Reaches Three-Year Peak at $2,920 per Tonne

https://discoveryalert.com.au/aluminum-price-2025-high-china-production-impact/

Citing Benefits of 232 Tariffs, Century Aluminum Announces Restart to Bring Mt. Holly SC Plant to Full Production

https://centuryaluminum.com/investors/press-releases/press-release-details/2025/Citing-Benefits-of-232-Tariffs-Century-Aluminum-Announces-Restart-to-Bring-Mt--Holly-SC-Plant-to-Full-Production-Increasing-U-S--Aluminum-Production-by-10/default.aspx

Alcoa: High US Aluminum Prices Offset Trump Tariff Costs

https://www.ttnews.com/articles/alcoa-aluminum-prices-tariffs

Reuters, Why did copper escape US tariffs when aluminium did not?

https://www.reuters.com/business/why-did-copper-escape-us-tariffs-when-aluminium-did-not-2025-08-05/

Reuters, Aluminium premium hits record in US on tariffs, global squeeze

https://www.reuters.com/business/why-did-copper-escape-us-tariffs-when-aluminium-did-not-2025-08-05/

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.