Bullets:

Nvidia faces severe challenges, as China’s monopolies on gallium allow its telecom providers to build low-cost 5G telecom across the world.

That leads to global adoption of Chinese standards and equipment for Artificial Intelligence.

To survive, Nvidia needs to keep lower-cost AI chips out of the US market. Nvidia is also desperate to sell billions of dollars’ worth of its own AI chips in the Chinese market, the world’s largest.

But even in the US and Europe, Nvidia desperately needs power prices to fall, as new data center construction faces soaring public opposition.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

This is a transcript, for the YouTube video here:

Report:

Good morning.

Everything about this is supposed to be impossible. But all the experts were wrong-- spectacularly wrong—yet again.

Nvidia is the world’s most valuable public company, worth over $4 trillion, and its CEO is meeting in the White House, again, to figure out what to do, how to save his company, and how to save the Artificial Intelligence industry in the West.

Looking here at the first three paragraphs:

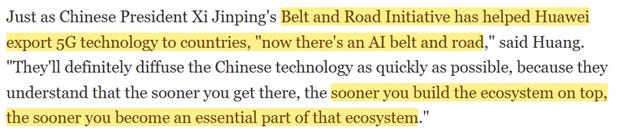

China will soon export its AI technologies across the world; think of the Belt and Road Initiative, but for Artificial Intelligence. That’s a given if Chinese companies like Huawei run away with the market. Huawei and other Chinese companies are building technologies that will mature and compete globally with the top American companies. China is a big important market – for chips and semiconductors – and it’s a mistake to concede the Chinese market to Chinese companies. Western companies need to compete for it.

That’s the introduction. But rewinding the tape, just a year or two, and what were our top experts saying? The entire objective of the sanctions against Huawei was to prevent China from developing artificial intelligences technologies at all. At the time, US companies were years ahead, and would remain so.

The Belt and Road Initiative was a failure, or so our top think tanks once believed, and said so to our top policymakers. It was a failure, and establishment Washington was celebrating the demise of the Belt and Road, just recently.

As to the semiconductors, the abandonment of the Chinese market was a deliberate strategy. Huang says here “we shouldn’t concede the entire market to them”—but that’s already happened, and it was by design. That was the point: Western tech was not allowed to go to China, and China would have to develop all these technologies for themselves. Zoom forward to today, and China did build them, and now China is exporting AI to other countries, and it is Huawei that is leading the way.

The Belt and Road Initiative. It has “helped Huawei export 5G technology to countries”, and that is a catalyst to those “countries adopting Chinese AI systems and standards.” Huawei has built the ecosystem, the platforms, the 5G telecom. The next logical step is for Huawei to supply everything else.

The reason why Huawei is able to supply the world with affordable 5G telecommunications, and why our companies cannot, is that China and Huawei enjoy monopolies on the key raw materials to build 5G. China’s gallium export bans mean that Chinese companies like Huawei have almost all the world’s gallium, and we need gallium to build 5G systems.

The White House, earlier, pointed this out, that Western countries and companies are vulnerable to any supply chain disruptions in gallium, and when China cut off exports of it, Ericsson and Nokia fell behind Huawei. Huawei can get it, so China’s monopoly in gallium leads right away to a monopoly for Huawei on 5G. Gallium just makes everything in telecom work better—faster data transfer speeds, more efficiency. It allows 5G base stations to be built lighter and smaller, and it’s used across the other hardware systems.

Huang and President Trump met in the White House, a follow-up to the previous meetings whereby Nvidia struck a deal: the Trump Administration will give Nvidia export licenses to sell to China—downgraded chips—and Nvidia in exchange will pay the US government 15% of sales. Sounds okay in theory, except for one big problem: China doesn’t want to buy Nvidia chips. And Nvidia’s market share in China went from 95% to zero.

Huawei and the other chipmakers here in China were supposed to be at least five to ten years behind our top companies. Huawei and the other Chinese telecom providers, like ZTE, were supposed to be out of business entirely. Instead we’ve got the head of Nvidia, the richest company on the planet, meeting with Donald Trump and saying that Huawei is the most innovative company in the world.

And underscoring the entire problem is electricity, which is the biggest long-term threat to Nvidia in the US and European markets. Nvidia obviously needs Chinese chips to be out of the US market, and Nvidia is desperate to be allowed to sell their chips in the Chinese market. But most of all, Nvidia needs US electricity prices to fall. Popular opinion is already mobilizing, fast, against the construction of US data centers, because electric bills are screaming higher every time another one gets built.

That isn’t a problem in China, where electricity just costs much less, and new power supplies are being added much faster than the growth in demand.

The data for Chinese electricity are hard to believe. Every year, Chinese new power demand is the same as the entire country of Germany. Add up all the power the is used by Germany, and that’s the NEW demand, from Chinese industry and households. But on the supply side, Chinese power companies are adding twice as much—two Germany’s worth of power supply.

So even with skyrocketing electricity demand in China, the supplies are going up twice as fast. That’s right now. US electricity supply hasn’t budged much for over a decade, and if everything goes perfectly well, the United States will quadruple nuclear energy production . . . in 25 years. That assumes construction goes smoothly, and that the Russians will supply us the uranium.

Be Good.

Resources and links:

Fortune, AI experts return from China stunned: The U.S. grid is so weak, the race may already be over

https://fortune.com/2025/08/14/data-centers-china-grid-us-infrastructure/

How much does the US depend on Russian uranium?

https://www.mining.com/web/how-much-does-the-us-depend-on-russian-uranium

Largest US companies by market capitalization

https://companiesmarketcap.com/usa/largest-companies-in-the-usa-by-market-cap/

Nikkei, Nvidia’s Jensen Huang warns of China’s AI ‘belt and road’ ambitions

Huawei has one 5G power that is hard for the US to hurt

https://www.lightreading.com/5g/huawei-has-one-5g-power-that-is-hard-for-the-us-to-hurt

Gallium Nitride Semiconductors in 5G Networks

https://www.azom.com/article.aspx?ArticleID=22494

Bloomberg, China Is ‘Rejecting’ Nvidia’s H200 Chips, Outfoxing US Strategy, Sacks Says

Choking off China’s Access to the Future of AI

https://www.csis.org/analysis/choking-chinas-access-future-ai

The Rise and Fall of the BRI

https://www.cfr.org/blog/rise-and-fall-bri

Support for AI Data Center Bans Is Growing

https://pro.morningconsult.com/analysis/ai-data-center-energy-prices-november-2025

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.

You make a compelling and I think, accurate, argument.

I wonder if we’ll see China own the ram and proc marker as prices to build a new pc in the US have at least doubled in the past 9 months.

I also wonder when the US is going to finally embrace solar… Probably not.

It’s going to be a long road ahead.