Bullets:

Coal prices are in steep decline across the world, and that should translate to collapsing profitability for coal miners.

But China’s blue-collar industries are rapidly adopting Artificial Intelligence and 5G smart systems across its operations, and are enjoying booming profits.

ZTE and Huawei build 5G systems in Chinese mines, which allow for autonomous driving, robots, and drones–even underground.

This poses a serious challenge for competitors in extractive industries outside China: they need to invest heavily in autonomous operations themselves, but Chinese firms like ZTE and Huawei own the supply chains for 5G telecom systems.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

For the YouTube video for this report, please click here:

Report:

Good morning.

Experts go back and forth, debating whether China has yet caught up to Western countries when it comes to the speed and performance of the high-end chips that make Artificial Intelligence possible. Most experts now concede that in large language models, Chinese companies are at least at parity, and far ahead in cost.

But we have maintained from the beginning that China is far, far ahead when it comes to industrial applications for AI. It’s everywhere we go here, everywhere we look. And it’s transforming Chinese industries, making them much more efficient and innovative and profitable.

That is showing up in unexpected places. China is the biggest coal miner in the world; coal is still critical in China’s electricity production. 93% of the world’s new construction for coal power is here, in China. The government approved 66 gigawatts of coal capacity last year, which is equivalent to roughly 66 new coal power plants.

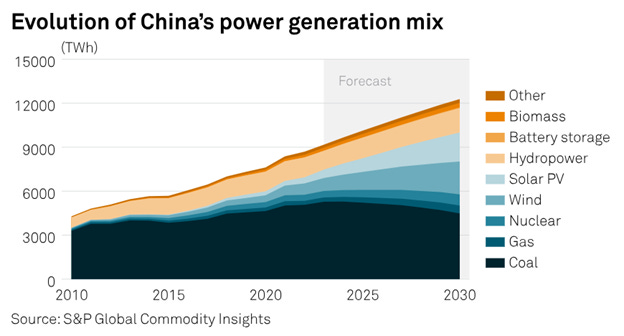

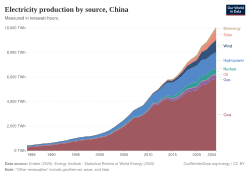

Those data make this chart here slightly misleading then. On a percentage basis of new power generated, coal is falling, with solar, hydro and wind rising fast:

But it’s this chart that’s more important. Total electricity output is soaring, so all the sources in that entire power generation mix is rising in absolute terms:

Coal prices are falling, globally, so we should expect coal mines to be less profitable, since this is such a labor- and capital-intensive industry. But Chinese coal companies are adopting AI across their operations, and showing higher profit margins than Morgan Stanley. Shaanxi is a huge coal-mining part of the country, and the CEO of the Dahaize mine there made an all-or-nothing bet on AI. Artificial and 5G telecom is everywhere in their operations, and it’s now the smartest coal mine ever built.

The company has fewer than a thousand employees, processing 20 million tons of coal output per year. Their workforce is tiny, given that production volume. They need fewer people because the machines do everything: Robots for autonomous tunneling, coal extraction, loading the railcars. A small crew of four is enough to identify new coal seams and start digging them out. Drones are used to inspect shafts in eight minutes, compared to hours in traditional mines. Self-driving trucks are everywhere, underground and above.

ZTE is another of the companies under sanction by the United States. The objective was to cripple this company, as our policymakers believed that Huawei and ZTE and others were dependent on the US and European markets to survive. Here they are, helping this coal mine book more profits than our own largest investment banks. For this mine, they built the industry’s first underground 5G system. The mine has zero latency—the time it takes data to move back and forth between the equipment and the operators.

Coal prices in China dropped 18% last year, yet this mine earned over a billion USD in revenues—that’s over $1 million, per employee. And to our point before, this is becoming common across all blue-collar industries, and is going to be a major problem for these industries everywhere else. China is automating – fast – its energy, steel and metals, chemicals, and manufacturing sectors. The efficiencies are rising, even while commodity prices are falling. Said another way, Chinese firms are making more profits by pushing prices down, through higher efficiencies.

The big competition in this space, ironically, is now between Huawei and ZTE—these are the companies that build the 5G networking technologies here in China. So to stay competitive, companies outside China need to build their own AI, and smart technologies, and “5G everywhere”—across their operations. But our companies aren’t allowed to buy anything from Huawei or ZTE, and the other telecom companies can’t get the gallium to build 5G systems, because of Chinese export bans on the gallium.

Be good.

Resources and links:

Coal still accounted for nearly 60% of China’s electricity supply in 2023: CEC

https://www.spglobal.com/energy/en/news-research/latest-news/energy-transition/013124-coal-still-accounted-for-nearly-60-of-chinas-electricity-supply-in-2023-cec

China’s AI Revolution Reshapes Coal Industry Profitability

https://www.sustainable-carbon.org/chinas-ai-revolution-reshapes-coal-industry-profitability/

Smart Mining: 5G Transforming Coal Production

https://www.zte.com.cn/global/about/sustainability/social/ESG-our-initiatives-smart-mining-5g-transforming-coal-production.html

How AI revolution is making a Chinese coal mine turn more profits than an investment bank

https://www.scmp.com/news/china/science/article/3304115/how-ai-revolution-making-chinese-coal-mine-turn-more-profits-investment-bank

How AI Revolution is Making a Chinese Coal Mine Turn More Profits Than an Investment Bank

https://www.coalzoom.com/article.cfm?articleid=39183

US Bans Huawei, ZTE Equipment Sales, Citing National Security Risk

https://www.voanews.com/a/us-bans-huawei-zte-equipment-sales-citing-national-security-risk-/6850966.html

FCC Bans Sale of New Devices From Chinese Companies Huawei, ZTE and Others

https://cset.georgetown.edu/article/fcc-bans-sale-of-new-devices-from-chinese-companies-huawei-zte-and-others/

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.

Aside, does this guy always thumbnail videos with his face taking up the left half of the frame? 🤷🏼♂️