Bullets:

More countries are converting their USD-denominated loans into RMB debt.

Borrowers of Chinese renminbi pay less than half in interest charges, compared to US dollar loans.

China’s massive Foreign Direct Investments across Asia, Africa, and even Europe are also important drivers of de-dollarization, as large new pools of offshore RMB are available for borrowing and loan repayments.

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

For the YouTube video for this report, please click here:

Report:

Good morning.

The world is moving away from US dollars to do their trading, and investing, and borrowing and lending. That means the world is also moving away from Western banks, and the SWIFT systems that run through Europe and the United States. The seizure of Russian reserves in the European banking systems was definitely a catalyst that moved the process along more quickly than otherwise, but it was inevitable anyway.

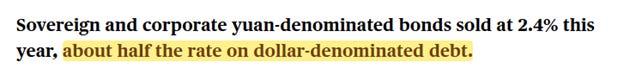

More countries are borrowing Chinese RMB, instead of US dollars, to finance infrastructure and trade. And that there is a key reason: it costs borrowers half as much, to borrow from Chinese lenders, in renminbi, than from Western banks in US dollars. That’s the most important driver, away from dollars and to the Chinese currency.

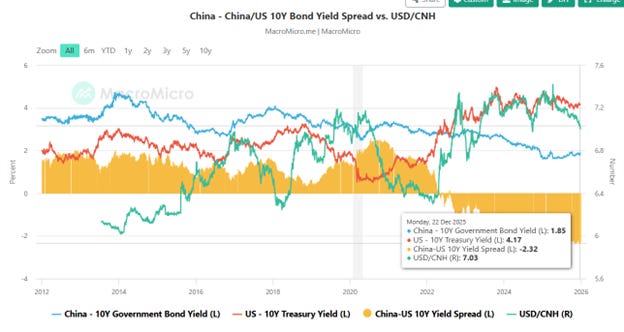

I apologize for this messy chart, but it makes our point. The yellow lines, over time, show the difference, or spread, between the Chinese and US 10-year government bonds. Private borrowers, and companies, pay higher interest rates than governments, and most borrowing rates around the world are based on government bond yields, plus the risk premium. So we use 10-year yields from different governments to get an idea of what credit-worthy borrowers are paying for money, denominated in those currencies. When those yellow bars go under the O percent line, it means that it is less expensive for borrowers to take out loans denominated in renminbi, compared to dollars.

In April, 2022, we crossed the 0 line: borrowers of Chinese renminbi and USD paid about the same rate. But rates were moving in opposite directions—US interest rates kept rising, sharply, because of high inflation and giant fiscal deficits in the United States.

Today, the yield spread is 2.32%: borrowers of US dollars pay interest rates over 2.3% higher, compared to borrowers of renminbi. It’s just less expensive for borrowers to repay in renminbi, if they can get the loans from Chinese banks in the first place.

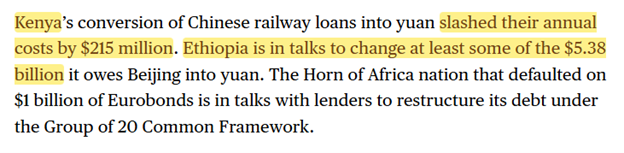

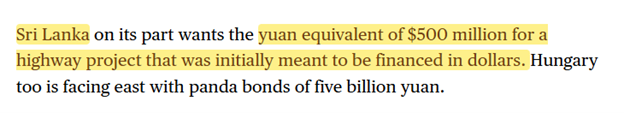

So that’s important as we go through this piece from Bloomberg. Kenya’s railway authority converted their USD loans to renminbi, and will save $215 million per year. Ethiopia owes $5.4 billion that they want to convert to RMB loans. Sri Lanka needs $500 million for a highway project, and Hungary wants five billion RMB to finance projects there.

The IMF is based in Washington, and they issued a statement, here, about these new loans:

They warn of currency risk: switching currencies is a “proactive approach to debt management”, but may create new vulnerabilities. The IMF encourages countries to carefully consider other things, like debt structure and currency reserves, balancing cost and risk. This is a legal–or academic–way of talking a lot without saying anything. It’s just a big word salad, and implies that countries that are borrowing and financing using RMB instead of USD don’t really know what they’re doing, haven’t thought their situation through. But the cold reality is that they’re better off getting away from dollars.

Because looking at just those countries mentioned. The CFO of the Kenya Railway System is of course looking to save $215 million a year in debt service costs, or he deserves to lose his job. But another feature of the China-Kenya relationship is that Chinese firms are pouring investment into the country. In April of this year alone, $430 million in new investment into Kenya’s agriculture sector, one for poultry, and another for aloe, grapes, and apples. Last month, China lent Kenya $1.5 billion to expand the highway system.

Ethiopia is next. In one month, $1.7 billion in new Chinese investments in mining and energy. In the renewable energy sector, China put in $850 million, and billions more into the Ethiopian rail and highways, telecom, and power. Sum total today is $5 billion across 2,000 projects, and 600,000 jobs.

Sri Lanka. Their big highway project was dead. That $500 million loan from China—denominated in RMB—means the project can proceed, even though the country itself is still technically in default on other loans. Usually countries that go through financial crises and sovereign debt defaults can’t get out for at least ten years, but these new loans from China can kick-start the Sri Lankan economy again, and at lower borrowing costs besides.

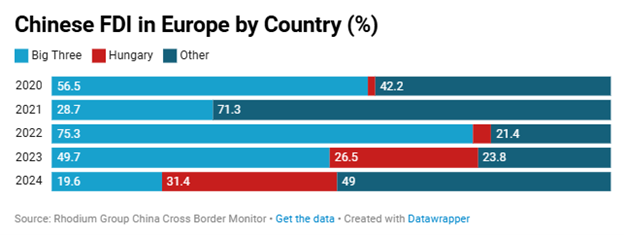

In the case of Hungary, Chinese firms are investing heavily into the country, much more so than the other countries in Europe.

The “Big Three” Euro economies are Germany, the UK, and France, and China has put more investment into China than the Big Three combined. So imagine you’re a CEO of a company in Hungary, and China is now your most important trading partner, and Chinese companies your most important investors. And your cost of capital, borrowing from Chinese banks, is less than half what you will pay if you borrow in Euro or in USD. If you don’t do the loan in renminbi, then you should probably lose your job too.

Be Good.

Resources and links:

Weaponisation of reserves likely to spur de-dollarization: Survey of central bank executives

https://www.centralbanking.com/central-banks/reserves/7972966/weaponisation-of-reserves-likely-to-spur-de-dollarisation

Why seizing Russia’s assets would be a gift to Beijing

https://responsiblestatecraft.org/seizing-russian-assets/

Beijing role in Africa’s green shift draws praise

https://global.chinadaily.com.cn/a/202512/25/WS694c8db5a310d6866eb3059c.html

Kenya turns to China for $1.5 billion highway expansion

https://www.reuters.com/world/africa/kenya-turns-china-15-billion-highway-expansion-2025-11-28/

Ethiopia secures multiple deals with China amounting to $1.7 billion

https://africa.businessinsider.com/local/markets/ethiopia-secures-multiple-deals-with-china-amounting-to-dollar17-billion/txk1w2j

IMF Issues ‘Currency Risk’ Warning As Countries Swap US Dollar Loans Into Yuan: Report

https://dailyhodl.com/2025/11/12/imf-issues-currency-risk-warning-as-countries-swap-us-dollar-loans-into-yuan-report/

China isn’t dumping dollars. They’re dumping banks, and setting up a new financial system.

IMF Flags Currency Risks as Nations Swap Dollar Loans Into Yuan

https://www.bloomberg.com/news/articles/2025-11-11/imf-flags-currency-risks-as-nations-swap-dollar-loans-into-yuan

How Hungary became China’s new factory hub in the heart of Europe

https://www.scmp.com/economy/china-economy/article/3313686/how-hungary-became-chinas-new-factory-hub-heart-europe

Sri Lanka resumes key highway project with $500 million new Chinese funding

https://www.reuters.com/world/china/sri-lanka-resumes-key-highway-project-with-500-million-new-chinese-funding-2025-09-17/

Kenya receives US$430m in agriculture investment pledges from China

https://www.ntu.edu.sg/cas/news-events/news/details/kenya-receives-us-430m-in-agriculture-investment-pledges-from-china

China - China/US 10Y Bond Yield Spread vs. USD/CNH

https://en.macromicro.me/charts/18341/cn-10-year-yield-spread-between-cn-and-us--vs-cnh

Trading Economics, global government bond yields

https://tradingeconomics.com/bonds

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.