Bullets:

The Israeli diamond industry is collapsing, as high tariffs and strong competition in the US market are crippling demand for natural stones from Israeli firms.

The US - Israel diamond trade is crucial to Israel’s economy, and the industry even directly supports the Israeli Defense Forces with over $1 billion a year. Moreover, the diamond trade in Africa is financed with illicit weapons sales and training by IDF commanders.

India replaced Israel as the top exporter of natural diamonds ten years ago, and Chinese-made artificial diamonds are increasingly preferred by younger buyers.

The market situation in the United States and the war in Gaza led to a collapse in Israeli lending and investment in the sector, which is now at historic lows. Wholesale diamond buyers are reluctant to visit Israel, and its annual diamond show was recently canceled.

For the YouTube video for this report:

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Report:

Good morning.

Israel’s diamond industry is collapsing, and insiders there say it faces existential threats because of developments in the United States, and across global markets. The president of the Israel Diamond Exchange is complaining here that the United States has high tariffs on diamonds from Israel, but lifted the tariffs on diamonds coming from the European Union. Israeli exports of polished diamonds fell 36%, year over year. The Israel-US diamond trade is critical to Israel’s economy—8% of Israel’s total exports, across all industries and countries across the world, are diamond exports to the United States.

So the US is the most important market for Israeli diamonds, and the loss of market share in the American market means that the industry is threatened with extinction. This is Forbes, whose readership is mostly American: If you have a diamond or ever bought one, you were probably supporting US-Israel trade, even though you probably didn’t know it.

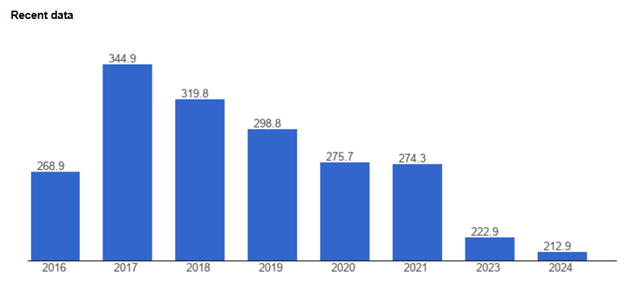

Until 2016, Israel was the top supplier of American diamonds, at least 30 percent, every year. But in 2016, India became the top importer of diamonds, with Israel dropping to #2. Here we see the problem for the Israelis—their number one customer for diamonds is the United States, and that market is going away.

The sources of diamonds are not documented, so few buyers know where the diamonds are actually coming from. Forbes says that American buyers of diamonds are unaware they’re buying from Israel at all, and that’s just the half of it. The Israeli Diamond Industry contributes about $1 billion a year to the IDF, and every time someone buys a diamond from Israel, some of that money goes to the military. That’s an Israeli economist saying that, by the way.

One example is here, that the head of Steinmetz Diamond Group has “adopted” a brigade in the IDF, and buys equipment. Israel is not a producer itself of uncut stones. The Israeli firms export low-cost rough diamonds, does the cutting and branding, and then exports the high value-added difference. In fact, none of the top five exporters of diamonds actually produce the gems, which are sourced primary from Africa.

So this industry, globally, is dependent on countries in Africa to dig up the uncut stones, getting them shipped out, then doing the high-end finishing elsewhere. How that tends to work for Israeli diamond companies is described here—International Diamond Industries got a monopoly on diamond production in the DRC, in exchange for weapons and military training by the IDF. The company paid $20 million for the concession, which generates $600 million per year.

In Sierra Leone, Steinmetz spent just $1.2 million to lock up half the company that produces 90% of all the diamonds there. In one year the company produced $200 million worth.

All these bribes and covert weapons transfers to African countries are for naught, though, given the changes in diamond markets, on the demand side, and in the United States most of all.

Per carat, Israel is earning fewer dollars than any time in recent memory:

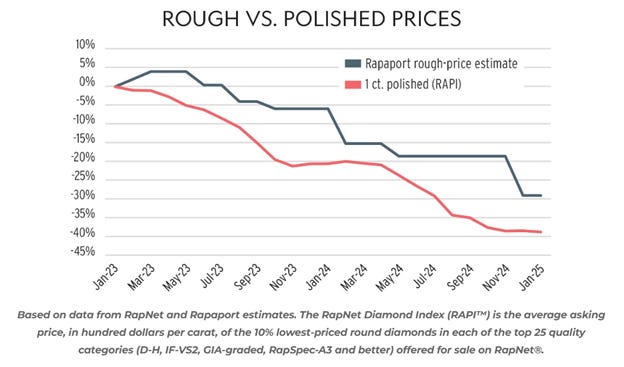

The blue line on this chart should be read as Israeli’s producer price—rough diamond prices are falling, which should be good news. But think of that red line as their top line number—the revenues received for polished stones. In just two years, raw materials costs fell 29%, but finished prices fell 39%:

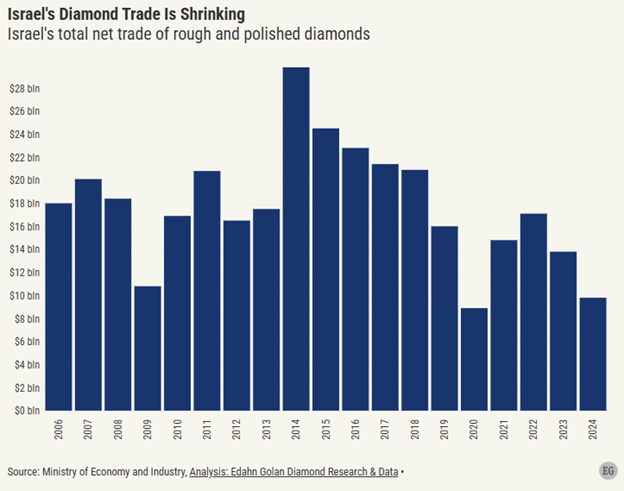

Israeli banks and investors are pulling out. Bank financing last year plummeted to $508 million, the lowest ever. A protracted decline in market activity means there is no business to finance—diminished utilization and allocation. Israel’s diamond trade is shrinking. This chart goes back twenty years, we see the extreme outlier year of 2020, the COVID year when nobody was allowed to go shopping for rings. The industry bounced back, but at a lower level than before, and the downward trend is clear.

The Israel Diamond Exchange is losing membership, and in the first 7 months of 2024, exports of polished stones dropped 33 percent year over year. In July they were down by half. Amid Israel’s war on Gaza, buyers stopped coming, and they eventually canceled the big International Diamond Week event.

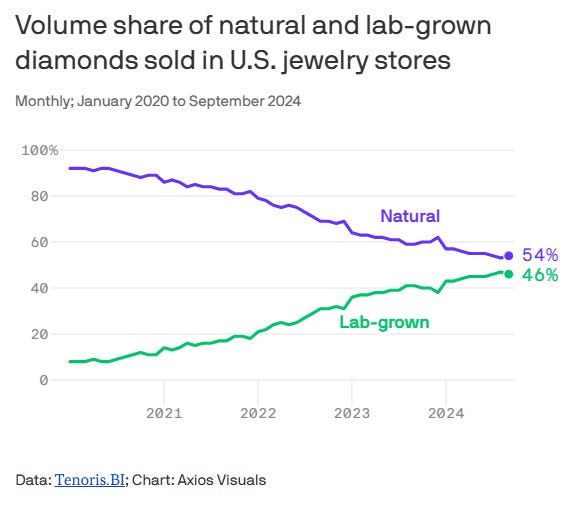

So India has taken the lead in the natural stone markets, while China is killing everyone with their monopolies on artificial diamonds. This chart goes back only 4 years. In January 2020, lab-grown diamonds were less than 10% of diamond sales in the US. Natural stones over 90%. By September of last year, they were almost at parity:

The appeal for lab-grown stones is economic, and obvious. Four years ago the average artificial diamond was 1.2 carats and cost $3887. In 2024, the size was 1.9 carats, 60% larger, but the price fell 30%. The shift is most notable among young people, who want lower prices for diamonds, and are indifferent whether they’re natural stones or come from a lab.

There are some big problems here for the Israelis, that probably won’t go away. It’s the younger generation of buyers that are turning away from natural diamonds in the first place, and it’s the younger generation that is far more likely to be persuaded by campaigns to boycott diamond products from Israel.

That generation understands too that this entire industry is based on little more than marketing gimmicks. The campaign to convince the world that diamonds are precious stones at all may have been the most successful ever. From the very beginning of the South African diamond rush days, the guys who ran the cartels knew they had to limit the supply that hit markets, to keep prices high. Later they asked New York for help marketing the diamonds, and “diamonds are forever” was born.

In 1940, only one American woman in 10 got a diamond ring on becoming engaged or married. Fifty years later it was 90%. Diamond sales in the US rose 9,000% in that time. Japanese bought in too: In 1967, just one woman in 20, and a mere 15 years later was 60%. Another brilliant strategy was the idea to spend 2 months’ salary on a ring. Men go into debt to buy inherently worthless stones.

The natural diamond industry is dying, and fast. Eventually the market decides what the prices are, and the market says the prices are going lower for diamonds used in jewelry, and the marketing in the world can’t stop it. The Israelis are no doubt making calls to Washington to get Trump to remove the tariffs in Israeli stones, but that will just delay the inevitable.

But there is another market for diamonds, for industrial applications. That market is booming, and it puts into sharp relief the moves by China, in the artificial stones market. China just announced strong export bans on the technology and equipment to make artificial stones, including the stones themselves. Those new regulations still allow Chinese firms to supply American jewelry stores.

But diamonds are becoming increasingly valuable as engineers develop more and more uses for them in industrial sectors, and China’s artificial diamond makers are incentivized, obviously, to help discover new uses and new markets for them. And those diamonds aren’t going anywhere except to factories down the street.

So for all the diamonds used in modern manufacturing, in heavy industry, and especially in military-industrial applications, and in all the products themselves, everything will be built in China.

Be good.

Resources and links:

Bloody Diamonds: How Your Engagement Ring Helps Fund a Genocide in Gaza

https://www.unz.com/article/bloody-diamonds-how-your-engagement-ring-helps-fund-a-genocide-in-gaza/

U.S.-Israel Trade Is Dominated By Diamonds

https://www.forbes.com/sites/kenroberts/2017/05/22/for-first-time-in-25-years-israel-not-no-1-provider-of-u-s-diamonds/

Israel’s diamond industry faces its worst crisis in decades

https://www.ynetnews.com/business/article/sjy2afqrxx

Millennial and Gen Z women want cheaper engagement rings

https://www.axios.com/2019/06/10/engagement-rings-price-millennials-generation-z

Rings get bigger as lab-grown diamonds catch up to naturals

https://www.axios.com/2024/10/12/lab-grown-diamond-vs-natual-popularity

The 2024 Diamond Crisis: An Industry at Its Breaking Point

https://rapaport.com/magazine-article/the-2024-diamond-crisis-an-industry-at-its-breaking-point/

Israel’s Diamond Financing Sinks to $0.5 Bln

https://www.edahngolan.com/israels-diamond-financing-sinks-to-0-5-bln/

Israel: Diamond exports, USD per carat

https://www.theglobaleconomy.com/Israel/diamond/_exports/_USD/_per/_carat/

Israel’s Top 10 Exports

https://www.worldstopexports.com/israels-top-10-exports/

Consumers Widely Accept Lab-Grown Diamonds, Even If Fewer Prefer Them

https://www.jckonline.com/editorial-article/consumers-accept-lab-grown/

Eleven of the top fourteen diamond-producing countries are in Africa

https://intelpoint.co/insights/eleven-of-the-top-fourteen-diamond-producing-countries-in-2022-are-africa/

Diamond Industry And Israeli Arms Trade Face Global Outcry

https://evrimagaci.org/gpt/diamond-industry-and-israeli-arms-trade-face-global-outcry-498132

Inside China / Business is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Inside China / Business via This RSS Feed.

Yayyyy